Credit cards are a modern-day necessity, simplifying transactions and a powerful tool for managing personal finances. While many Americans struggle to stay afloat in a sea of debt, the wealthy elite have discovered the art of utilizing credit cards to their advantage. Let’s dive into the world of the affluent and explore how they maximize the benefits of credit cards to maintain and even enhance their opulent lifestyles.

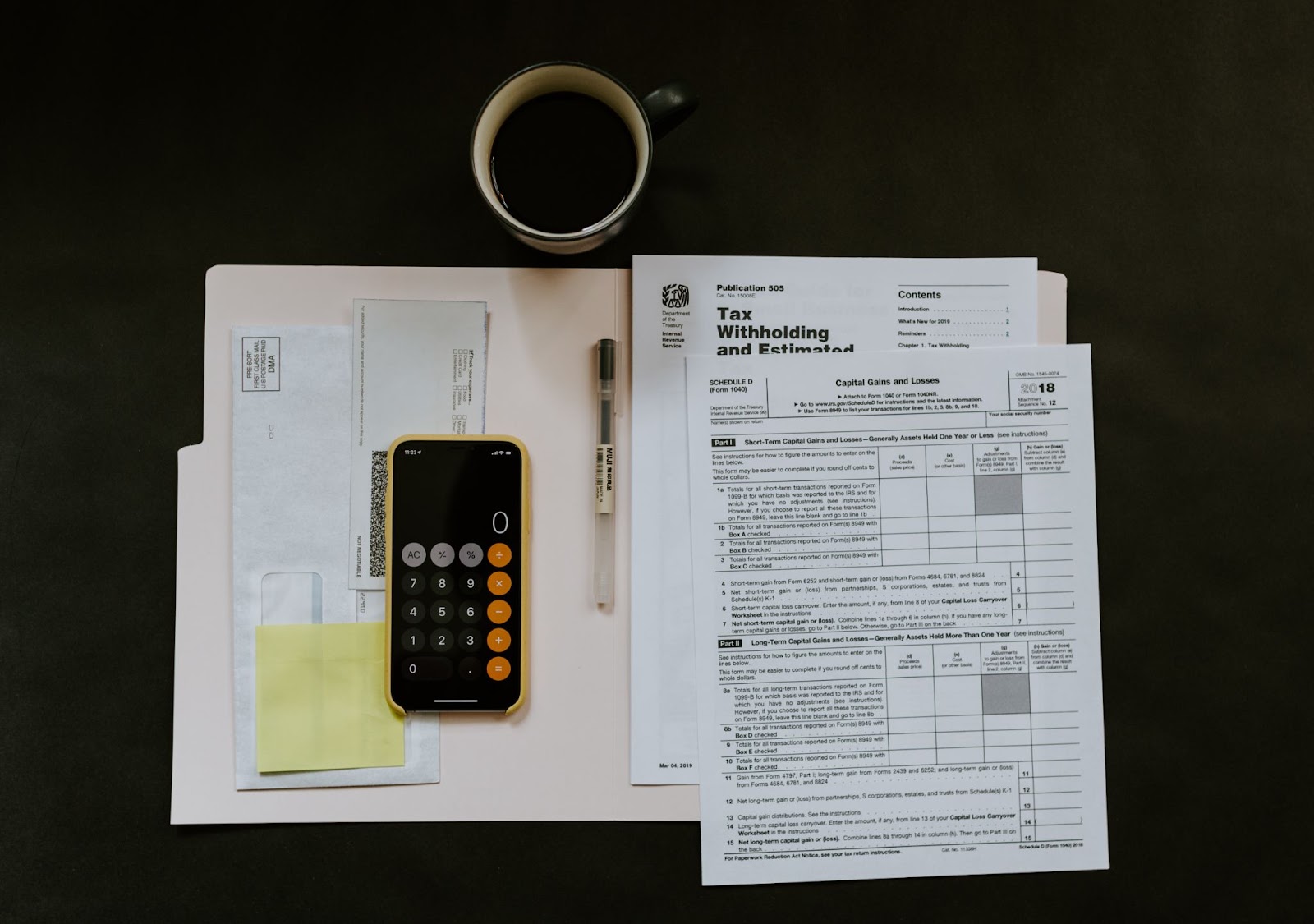

Rich folks often wield credit cards as an essential financial tool. They use them for large purchases, travel, entertainment expenses, and more, all while enjoying the added security that credit cards provide through fraud protection and insurance on purchases.

It’s not merely about spending; there’s more to the story. Wealthy Americans cleverly tap into the exclusive benefits and rewards that high-end credit cards have to offer. These enticing advantages include cash back, travel points, and a variety of other luxurious perks that can make a truly significant and remarkable difference in their already opulent lifestyle.

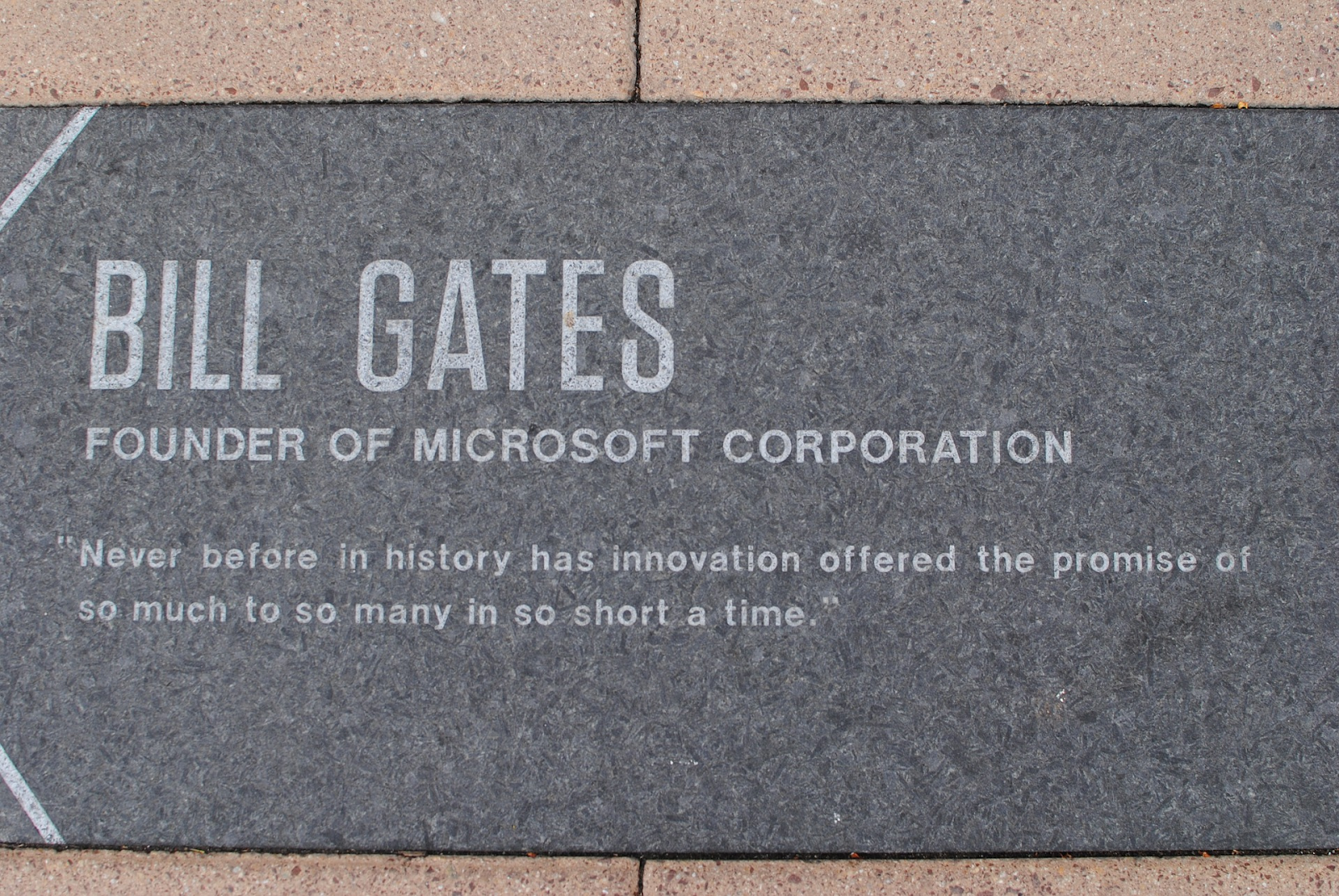

The rich elite have mastered the art of earning credit card rewards. They effortlessly amplify their wealth by strategically choosing cards with lucrative sign-up bonuses and high cash-back rates. Credit card rewards can be donated, used for personal indulgence, or shared with family members, making them a powerful asset in the hands of the affluent.

Moreover, the perks of credit cards are not just limited to rewards. Wealthy individuals can use card benefits such as grocery credits, airport lounge access, and flight priority boarding. These premium cards may carry hefty annual fees, but the lavish perks often outweigh the costs, especially for those who spend tens of thousands of dollars annually.

Luxury purchases are another area where the rich elite capitalize on their credit cards. High-end fashion, jewelry, and other luxury goods can be bought using credit cards, allowing for flexibility in payments and earning additional rewards and perks.

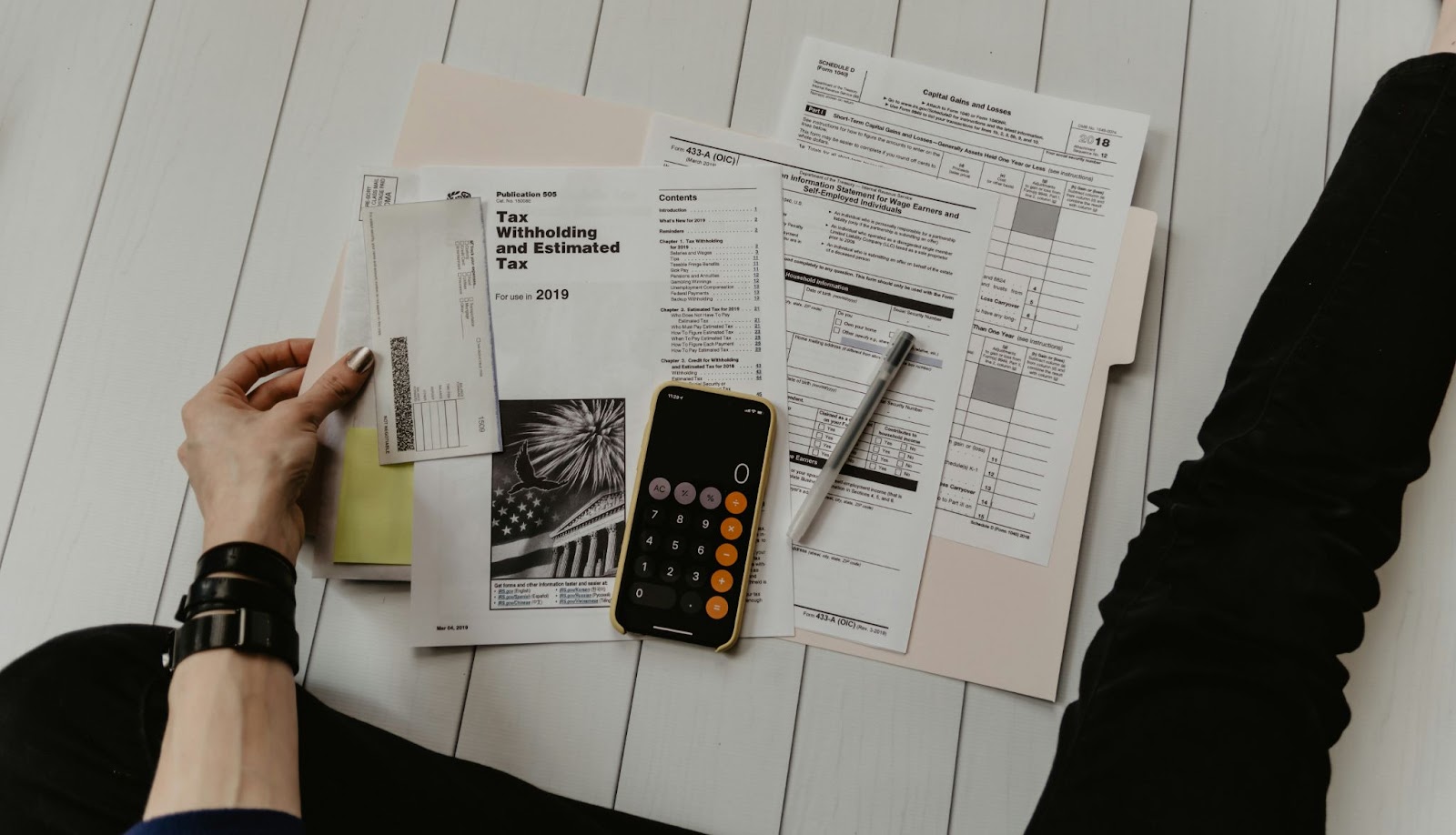

The wealthy also use credit cards to manage their cash flow. Making large purchases on credit allows them to finance investments and seize lucrative opportunities without paying upfront. By diligently paying off their balances, they avoid high-interest charges, keeping their finances in check.

Credit building is an indispensable and vital aspect of financial management, even for the affluent and wealthy. Maintaining a robust credit score can open doors to low-interest loans and attractive credit lines, ensuring that these prosperous individuals consistently have access to the most profitable financial opportunities available. In this context, credit cards play an incredibly crucial and pivotal role in building and maintaining a strong, impressive credit profile for continued financial success.

Finally, wealthy Americans benefit from the fraud protection that credit cards offer. With real-time fraud monitoring and instant alerts, they can stay one step ahead of potential threats and safeguard their hard-earned fortune.

In conclusion, credit cards are not just about spending beyond one’s means. The wealthy elite have unlocked the true potential of credit cards, transforming them into powerful tools for financial management, rewards, and security. With strategic planning and responsible use, credit cards can unlock the door to a wealthy lifestyle.