Putting a price tag on an individual’s worth is no easy task. It may be easy to price a house, a car, or any one of the technological advancements – but to price a human’s value is certainly a gray area. Delaware Chancery Court Chancellor Kathaleen McCormick appears to agree, as she denied Elon Musk’s $56 billion Tesla pay package, the largest CEO compensation package in public corporate history.

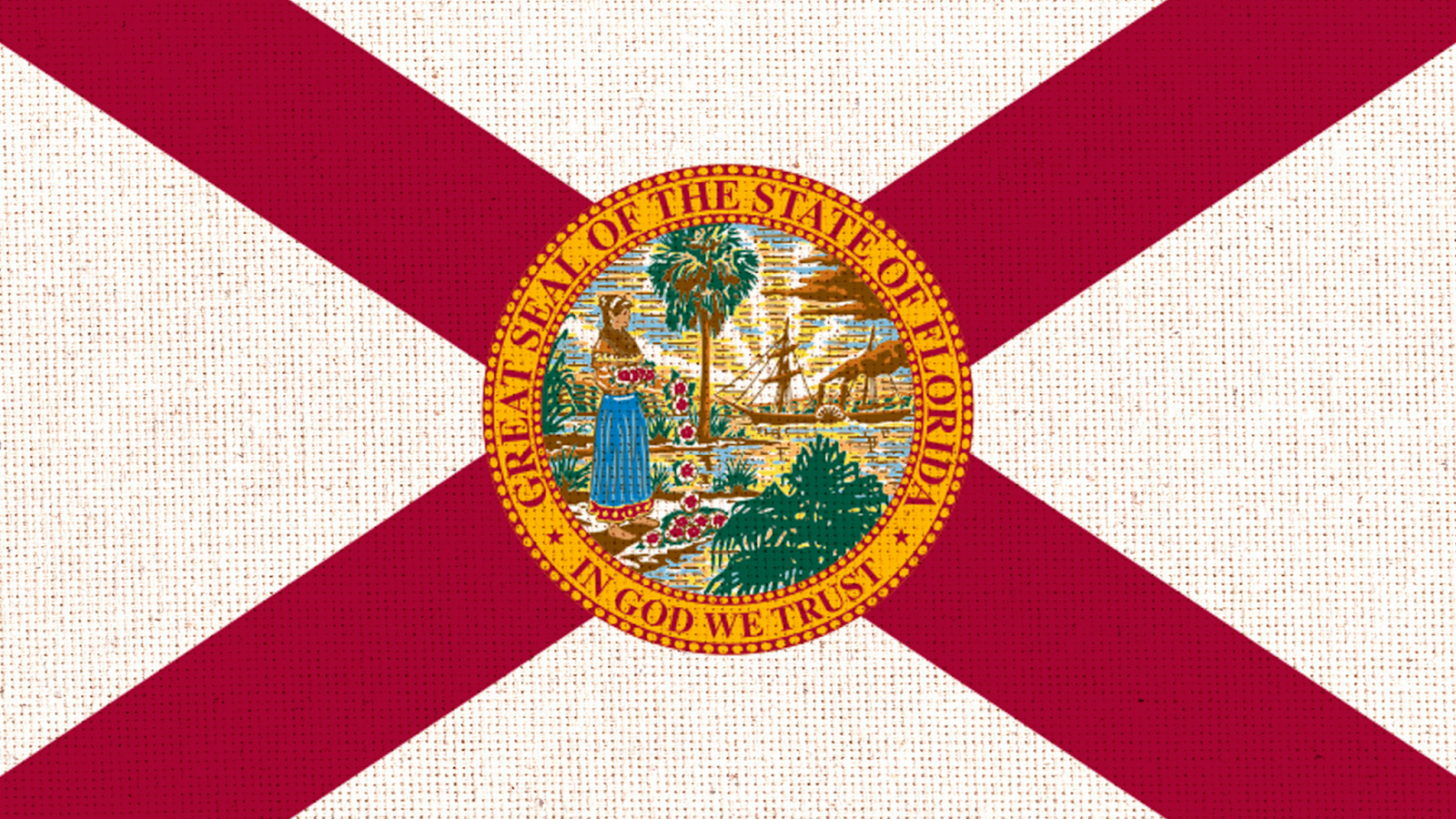

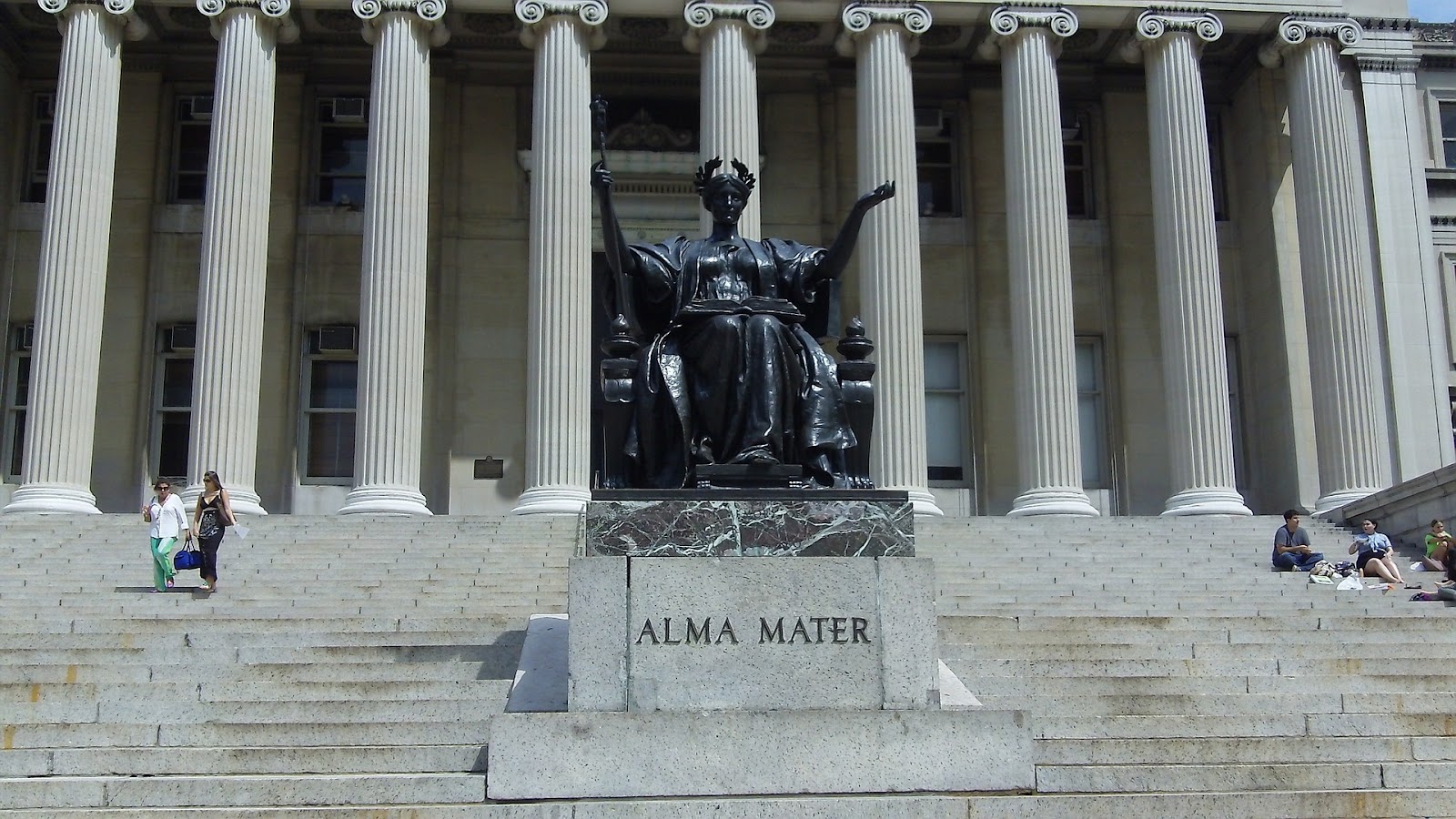

McCormick, who analyzed how much independence the Tesla board had, argued that “neither the Compensation Committee nor the Board acted in the best interest of the Company when negotiating Musk’s compensation plan. In fact, there is barely any evidence of negotiations at all.” Delaware, home to more than 60% of the Fortune 500 that have incorporated in the state, has elicited the wrath of Musk.

After the Delaware Court’s ruling, the Tesla CEO took to social media, declaring war on the Diamond State as the place for companies to be in business. Musk is urging other big businesses to flee the state, tweeting on Monday, “Move your company out of Delaware before they lock the doors.”

Oftentimes, leaders of large publicly traded companies choose to incorporate in Delaware, even though they have no physical presence there. This is because the state often has a predictable court system with specialist judges and non-jury trials.

While it is not clear if shareholders will vote in Musk’s favor, the billionaire posted about reincorporating the electric vehicle maker in Texas, where it already has its headquarters. But if big businesses want to move out of Delaware, the state’s laws have made it easier to reincorporate somewhere else. Since a law change in 2022, companies can leave the state with the approval of a majority of shareholders, whereas companies previously required unanimous shareholder approval to move.

But as human behavior evolves and shifts, so do the laws governing society. Where it was once easier to reincorporate, Delaware’s Chancery Court is now considering how closely they must evaluate moves that arguably benefit a controlling shareholder. Enter: TripAdvisor.

Currently, there is a shareholder lawsuit against the travel company’s planned reincorporation in Nevada. TripAdvisor’s shareholders argue that the company’s move is an attempt to save Gregory Maffei, head of the brand’s parent company, from accountability for potential self-dealing. However, the idea of blocking companies from reincorporation “is pretty strained,” according to Chancery Court Vice Chancellor Travis Laster.

Yet, Musk’s call to action appears to have drawn the attention of big forces in the country. Texas Governor Greg Abbot received Musk’s declaration well, looking to challenge Delaware’s position as the preeminent business court in the U.S. Supporting businesses reincorporating in other states, Former U.S. Attorney General William Barr suggested companies consider other states that now have their own designated business courts.

Experts remarked that states vying for companies to not incorporate in Delaware is nothing new, and Musk’s war is not likely to produce noticeable results. The Blue Hen state has been the primary place of incorporation in the country for several decades due to its business-friendly corporate laws and specialized court. This court allows the settling of disputes to move quickly without a jury.

Thus, an extensive body of case law has been created and is valued by large institutional shareholders. However, the biggest factor that strengthens Delaware’s dominance is that corporate regulation seems to be a main focus for the state’s government, resulting in a neutral view by investors and managers.