The Middle East and North Africa region has emerged as one of the main drivers of growth in affluent travel, recording high spending with a display of sustainable eco-luxury and meaningful cultural experiences. Mastercard’s report “Affluent Travel: A Middle East Perspective” was released during the Arabian Travel Market 2024, and detailed some of the trends within the MENA region.

New experiences in unexplored destinations, micro-trips, as well as “bleisure” will likely drive the growth of the luxury travel market, which, according to a report by Grand View Research, is expected to grow by 7.9% (CAGR) in the six years between 2024 and 2030. High-net-worth travelers contribute 36% of the global spend on travel, according to a Jones Lang LaSalle study.

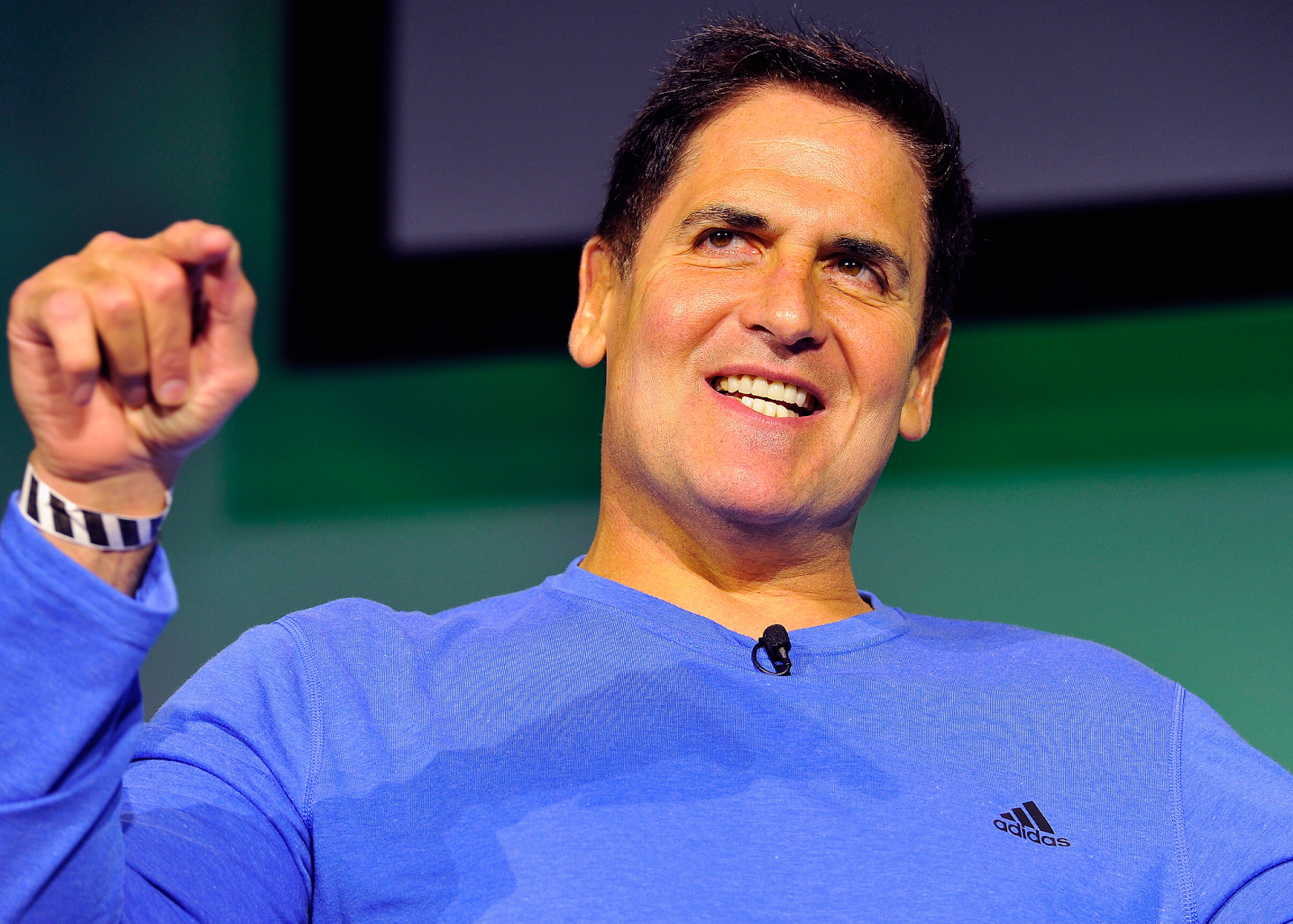

Amnah Ajmal, Executive Vice President of Market Development EEMEA at Mastercard, said: “At Mastercard, we are committed to connecting people to their passion for travel. This report gives a great snapshot of how high-net-worth individuals choose to travel, and it’s wonderful to see sustainability, cultural immersion, and purpose as key considerations, along with quality accommodation, seamless technology, and loyalty benefits. We will continue to harness the power of partnerships with leading industry players to come up with innovative solutions that unlock access to a whole new world of unparalleled travel experiences.”

Over a third (36%) of those taking luxury trips say they want to experience the world’s cultures. The combination of business and leisure—”bleisure”—is resulting in more remote work trips as digital creators and workers change the way people travel. Affluent travelers are almost twice as likely to take a vacation as an extension to a business trip, and Marriot Bonvoy’s research shows that solo travel is being embraced, with 70% of respondents in the UAE and 69% in Saudi Arabia claiming to have traveled solo.

Affluent consumers are early and careful adopters of the conscious travel trend, and place a premium on the authentic experience of eco-luxury. These types of travelers tend to associate with travel brands that support local communities, stay in luxury eco-friendly accommodations, and pay more for less carbon-intensive transport.

A YouGov report states that this segment of travelers places a greater emphasis on the experiences of travel rather than on physical goods. Half of affluent travelers prioritize the meaningful experiences they have over luxury shopping and even souvenirs. Almost a quarter of them stated that they are willing to pay for more remote destination experiences, customized tours to connect with the culture of the area they are traveling in, and eco-friendly resorts. However, they do say that luxury accommodation is a high priority, with 27% stating they would pay more for villas and chalets in secluded and private locations, and 21% being happy to splurge on luxury stays on a private island. Younger travelers are also more likely to pay for Michelin-starred restaurants or unique gourmet experiences.

Based on the average spend per card by the origin market, GCC Travelers are among the highest spenders. A 2023 Mastercard Economics Institute reports that Kuwaiti tourists spend on average $3,390 per card in Paris, which is five times as much as their American counterparts. These users are also power users of loyalty and membership cards—34% compared to an average of 24%.

As younger generations continue to amass wealth, Millennials (who are aged 30 to 44 years) comprise the highest percentage of luxury seekers, followed by Gen Z (ages 15 to 29). However, Gen X (ages 43 to 58) is also expected to make the highest contribution to travel growth, according to a report by Arabian Travel Market.