India’s burgeoning economy has painted a contrasting picture. On the one hand, concerns over growing economic disparities have been on the rise, and on the other, the country has witnessed a remarkable surge in its millionaire count. Within a year leading up to mid-2018, India added an impressive 7,300 new millionaires, bringing the total count of dollar millionaires to 3.43 lakh. Their net worth is an astounding U.S. $6 trillion, per a report.

In its 2018 global wealth report, Credit Suisse has shed light on India’s prosperous landscape. Notably, India boasts one of the largest contingents of female billionaires, with the percentage standing at an impressive 18.6% during the specified period, positioning it among the top-ranking significant countries in this regard.

By the middle of 2018, the country’s wealth, when evaluated in dollar terms, witnessed a modest growth of 2.6%, totaling around U.S. $6 trillion. However, the wealth per adult remained more or less unchanged at U.S. $7,020. This stagnation is primarily attributed to the rupee’s depreciation against the dollar.

The projections for the future also indicate an expansion in wealth. By 2023, the number of Indian millionaires is anticipated to swell by over 53%, reaching an estimated 5.26 lakh individuals with a collective worth of nearly U.S. $8.8 trillion. Indian personal wealth seems to have a significant skew toward property and other tangible assets, constituting 91% of the estimated household assets. In the year leading up to the report, non-financial assets grew 4.3%, the primary driver for the nation’s wealth ascent.

Real estate, often seen as a reflection of non-financial household assets, has been on a growth trajectory with a peak growth rate of 9% for India. Moreover, despite the notable rise in wealth, its distribution remains skewed. A significant chunk of the populace, 91%, possess wealth less than $10,000, highlighting the economic disparity. This number, however, is projected to shift, with expectations that the wealth of Indian millionaires will expand at an 8% annual rate, reaching U.S. $8.8 trillion by 2023.

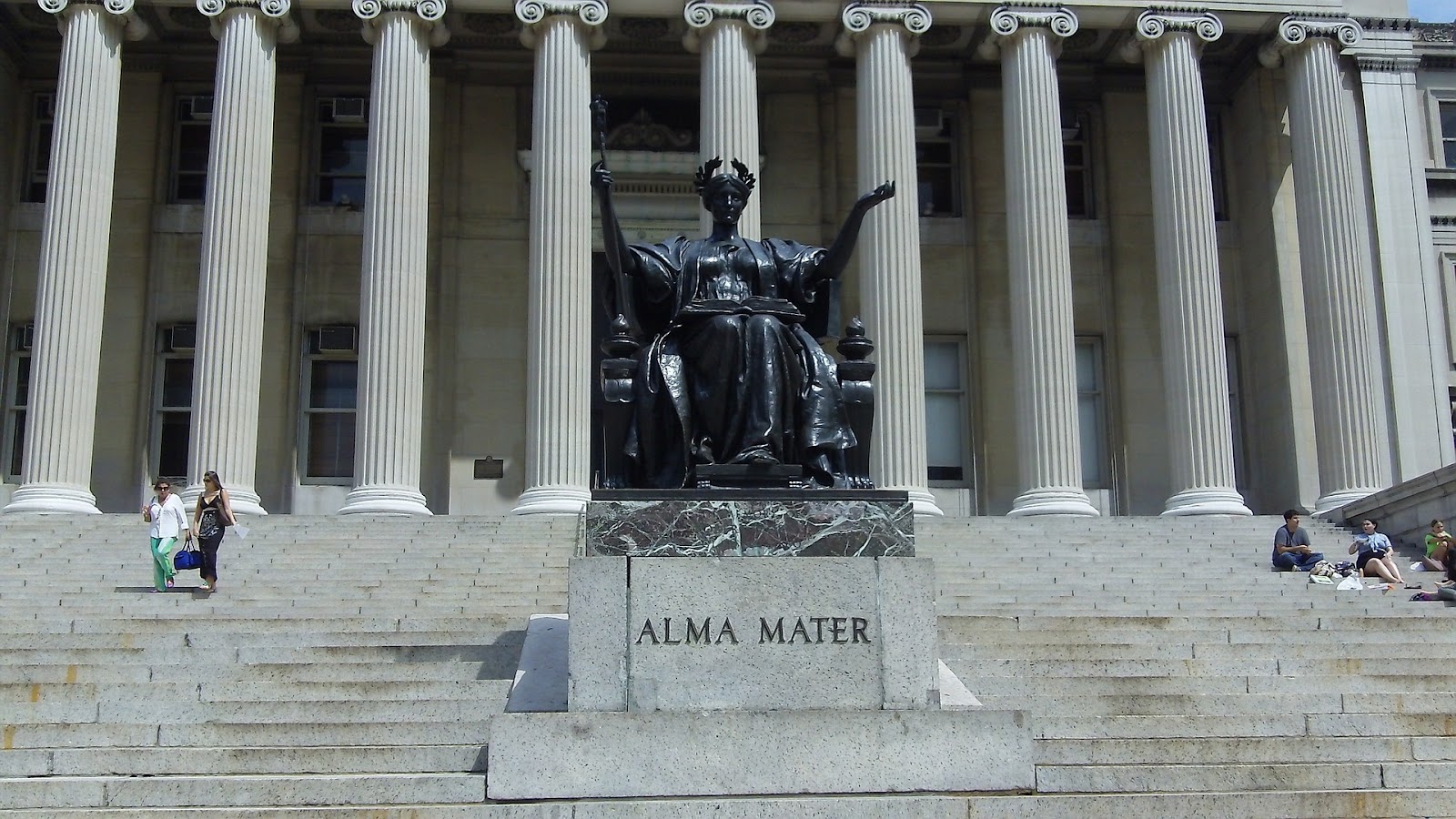

In the global arena, the United States retains its top spot in the wealthy nations’ club, marking its 10th consecutive year of leadership. During the assessment period, the U.S. contributed a staggering U.S. $6.3 trillion to global wealth, elevating its total to a monumental U.S. $98 trillion. This decade-long increment in total wealth and wealth per adult is a testament to the U.S.’s robust economy.

China, trailing the U.S., occupies second with the most affluent households. The Chinese economy added assets worth U.S. $2.3 trillion, reaching a U.S. $52 trillion net value. Forecasted growth for China is equally optimistic, with an anticipated U.S. $23 trillion increase over the subsequent five years. This surge would enhance China’s stake in global wealth from 2018’s 16% to an estimated 19% by 2023.

While North America witnessed growth primarily through financial assets, non-financial assets spurred growth in other regions. These tangible assets were responsible for a considerable 75% of the wealth increment in areas like China and Europe, and they wholly drove India’s wealth ascent.