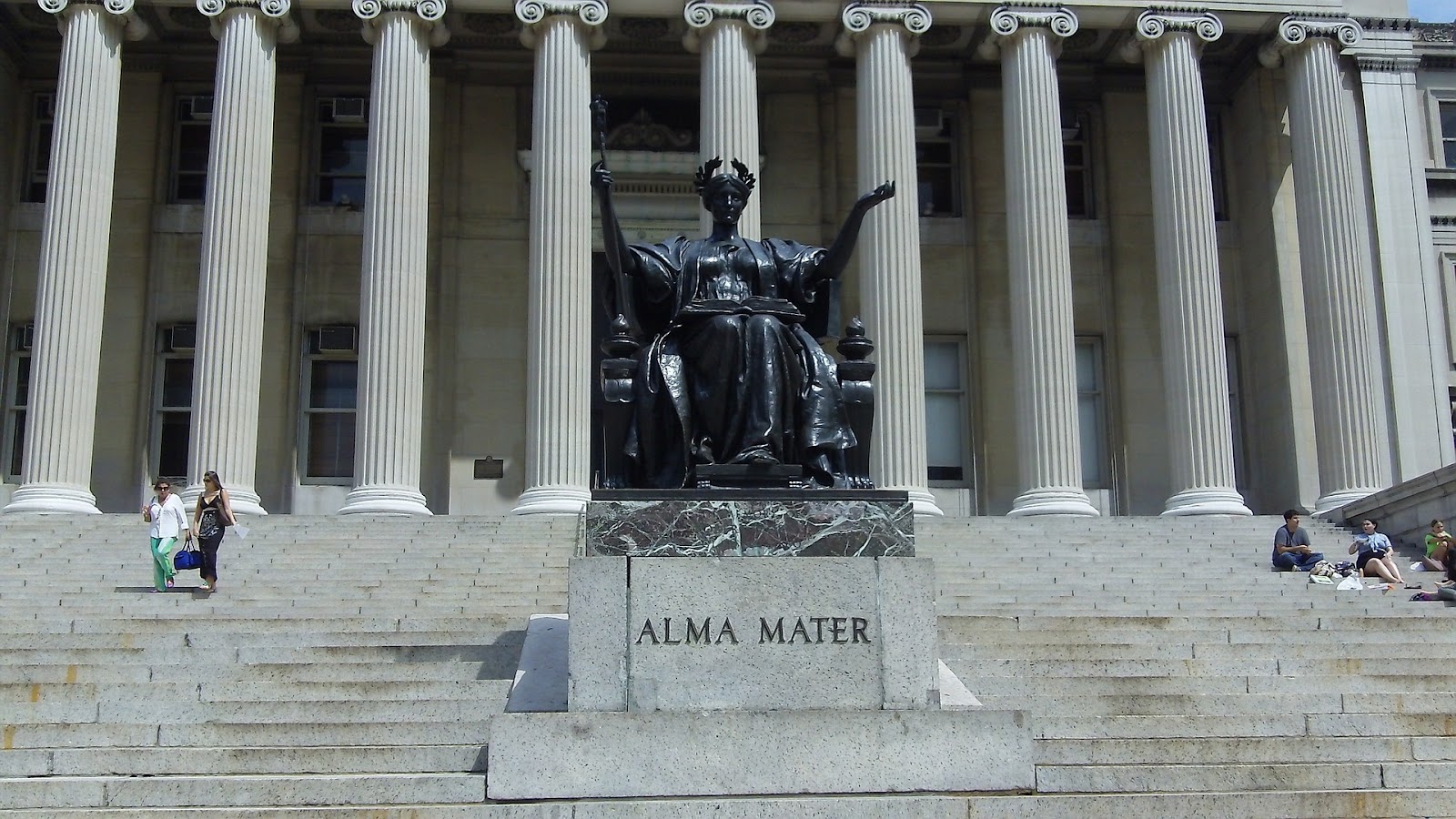

In the wake of the pandemic, New York has seen a significant increase in its millionaire population, contradicting the narrative of a widespread departure of the affluent to regions with lower taxes. The Fiscal Policy Institute (FPI) reports that between 2020 and 2022, around 17,500 new millionaire households emerged in New York, a figure that notably outweighs the net loss of 2,400 millionaires due to migration over the same period.

This increase in the number of millionaires in New York stands in stark contrast to the prevalent outlook during the early stages of the pandemic. At that time, it appeared that high-profile billionaires and affluent financiers were leaving the state in large numbers, likely in search of sunnier climates and more favorable tax regimes in the Sun Belt. Data from FPI, a left-leaning policy organization, highlighted a 78% year-over-year increase in the migration of high-earners – individuals earning at least $815,000 annually – from New York City in 2020. This trend sparked concerns about the state’s ability to retain its wealthiest residents.

However, the current data tells a different story. Nathan Gusdorf, FPI’s Executive Director, points out that New York is not struggling to keep its affluent citizens. The primary contributor to the surge in millionaire households is the exceptional performance of the financial markets in 2021. That year saw a 40% increase in the collective income of tax filers earning more than $1 million, reaching a staggering $407.5 billion.

Contrary to popular belief, it was observed that the majority of high earners who left New York did not move to states with lower taxes. Instead, they relocated to other states with similar or higher tax rates, such as Connecticut, New Jersey, and California. The report reveals that among the top 1% of earners, 73% chose to move to another high-tax state.

These findings challenge the narrative that high-tax states like New York are inherently unattractive to the wealthy. This influx of millionaires and the resilience of the state’s high-earner population indicate a complex array of factors influencing migration decisions. Economic opportunities, lifestyle preferences, and the robustness of local markets appear to play a significant role in these decisions, beyond the simplistic calculus of tax rates.

The pandemic has undeniably reshaped many aspects of life, including migration patterns and financial dynamics. While the initial exodus of the wealthy from New York City garnered much attention, the rebound and growth in the number of millionaires are equally noteworthy. This trend may have implications for the state’s economy, tax revenues, and social dynamics.

As the world continues to adjust to the post-pandemic reality, the case of New York’s millionaire population highlights the need for a nuanced understanding of economic trends and human behavior. The state’s ability to not only retain but also attract a significant number of high-net-worth individuals speaks to its enduring appeal and resilience.

As policymakers and economists evaluate the lessons from this period, New York’s experience serves as a reminder that economic forecasts and migration trends can often defy expectations. The state’s continued allure to the wealthy, despite high taxes and initial pandemic-related challenges, underscores the multifaceted nature of financial decision-making and the enduring appeal of New York’s unique economic and cultural landscape.