Image credit: Unsplash

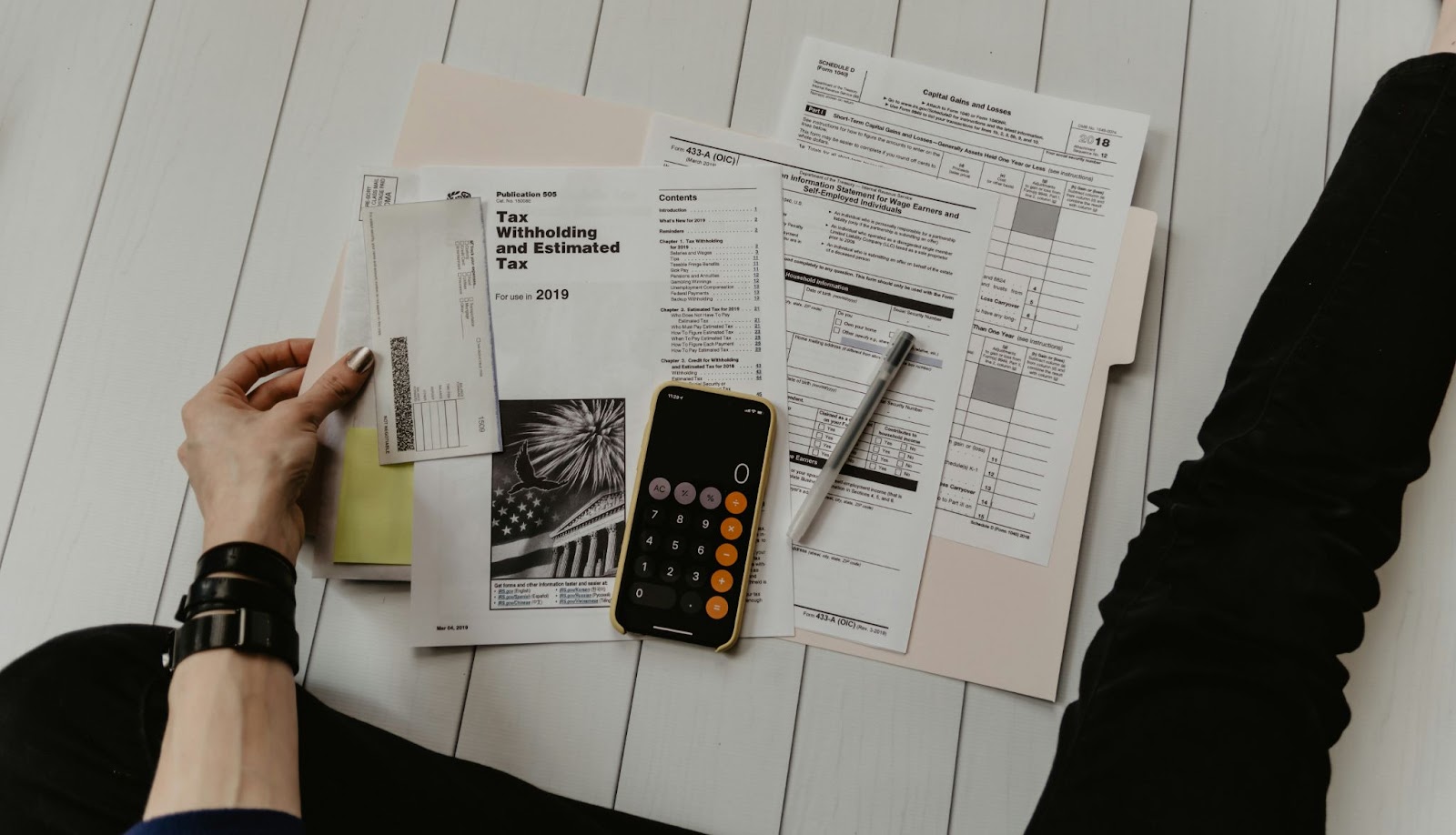

The IRS announced earlier this month that they will be cracking down on wealthy taxpayers who owe back taxes in the 2024 fiscal year. The IRS’ recent influx in funding from the Inflation Reduction Act makes this possible. Instated in 2022, the Inflation Reduction Act was partially invoked to investigate millionaires suspected of tax fraud.

According to IRS commissioner Danny Werfel, the IRS’ funding has dropped significantly recently, leading to the lowest audit rates of wealthy tax filers. A team of IRS researchers and academic economists has reported that the top 1% of income earners in the United States fail to write over 20% of their yearly earnings. With the decrease in funding, audits on million-dollar tax returns dropped by two-thirds, despite the number of million-dollar earners increasing by 50% over the last decade.

The increase in the top 1% of earners has led to structural changes within the IRS’ audit system. The agency announced that dozens of revenue officers will focus exclusively on high-end collection cases in the 2024 fiscal year, which begins in October 2023. The most pressing item on the agency’s agenda is 1,600 millionaires who owe at least $250,000 each in overdue taxes.

Werfel explained the urgency of investigating these millionaires, saying, “If you pay your taxes on time, it should be particularly frustrating when you see that wealthy filers are not,” during a call with reporters. This sentiment is echoed by many filers who struggle to earn income and pay taxes.

Sentiments toward the IRS have been particularly negative over the past few years. The drop in audit staff is not only due to lack of funding. The number of auditors employed by the IRS has dropped from 94,000 in 2010 to 82,000 in 2021 despite the population of the United States growing significantly over the same period. IRS employees have reported feeling extremely unsafe when performing in-person audits. Revenue officers are unarmed and untrained in defending themselves against the potential ire of the individuals they visit. In August, the agency announced that they would stop conducting unannounced revenue officer stays altogether to protect the safety of their workers. This also helps reduce the number of successful scams involving someone pretending to be a revenue officer.

The Inflation Reduction Act directed $80 million in funding to the IRS, explicitly targeting increasing staff and cracking down on high earners who fail to report their total income. It is much less common for those who earn under $400,000 annually to cheat on their taxes simply because W-2 forms are less complex than forms reporting several income streams. The IRS also plans to scrutinize 75 large business partnerships with assets averaging $10 billion. The agency also plans to use the extra funding to invest in AI software to help track discrepancies.

The Inflation Reduction Act issues a new era for the IRS, promising to cut down on millionaire tax fraud and bolster the United States government funding.