Image credit: Unsplash

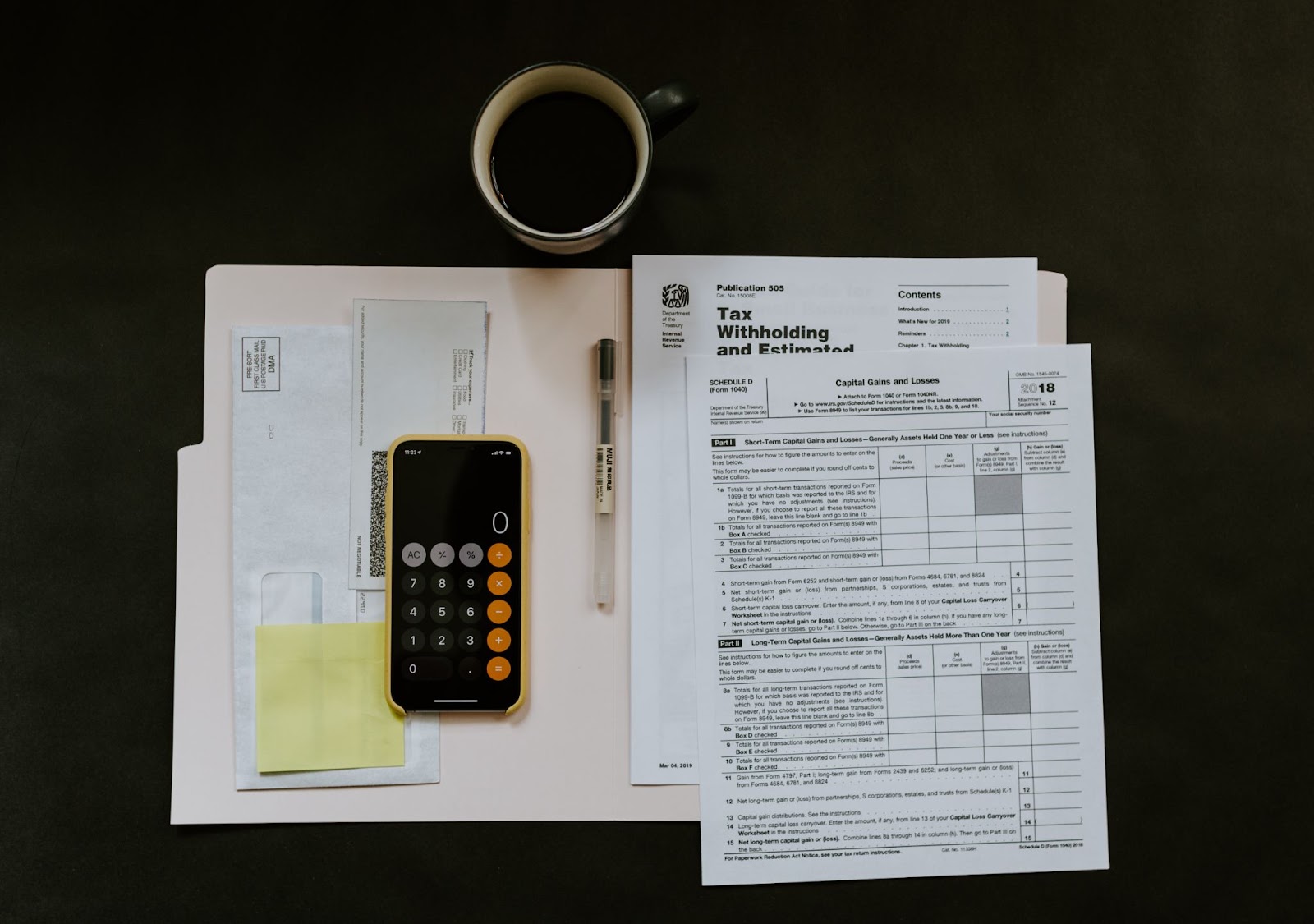

On Friday, January 12, the Internal Revenue Service (IRS) announced that it has recently collected over half a billion dollars from multiple millionaire Americans who previously owed tax debt. The IRS credited the approval of the Inflation Reduction Act for its elevated ability to pursue “high-income, high-wealth individuals.” The Inflation Reduction Act (IRA) also targets large corporations and complex partnerships not paying overdue tax bills.

Pushed by President Joe Biden and approved in 2022, The IRA earmarked $80 billion over ten years to ramp up the enforcement capabilities of the IRS. Although $20 billion was eventually removed in 2023 as part of the deal to head off a debt-ceiling crisis, the agency specified it had already used its original allotment.

The IRS said that over the past year, enforcement officers had recovered approximately $520 million from the most well-off segments in the country. IRS Commissioner Danny Werfel released a statement.

“The IRS continues to increase scrutiny on high-income taxpayers as we work to reverse the historic low audit rates and limited focus that the wealthiest individuals and organizations faced in the years that predated the Inflation Reduction Act.” Werfel continued, “We are adding staff and technology to ensure that the taxpayers with the highest income, including partnerships, large corporations, and millionaires and billionaires, pay what is legally owed under federal law.”

President Biden’s administration previously vowed to freeze audit rates for tax filers with $400,000 or less. The IRS expanded on the announcement of the Inflation Reduction Act, saying that its latest efforts have been primarily concentrated on taxpayers with more than $1 million in taxable income and more than $250,000 in back tax debt. Following an initial round of audits of 175 high-income earners that yielded $38 million, the audits expanded last autumn to include 1,600 new taxpayers in this category. These taxpayers collectively owed hundreds of millions of dollars in back-due taxes, and the IRS has ultimately collected $482 million from these individuals, partnerships, or corporations.

According to the IRS, the agency has also honed in on 76 of the most significant corporate partnerships in the United States. These large partnerships are those with over $10 billion in assets and whose structure may designate a compliance risk. The partnerships at hand ultimately represent a significant cross-section of prominent industries. A statement from the agency said these partnerships include hedge funds, publicly traded partnerships, real estate investment partnerships, large law firms, and other industries.

On the IRS website, the agency noted in the announcement that IRA “resources continue to help in a variety of areas. In addition to earlier announcements focusing on further improving taxpayer service during the upcoming 2024 filing season.”

Werfel said, “We are focused on improving our taxpayer service for hard-working taxpayers, offering them more in-person and online resources as part of our effort to deliver another successful tax season in 2024.” He added, “The additional resources the IRS has received is making a difference for taxpayers, and we plan to build on these improvements in the months ahead.”