Image credit: Unsplash

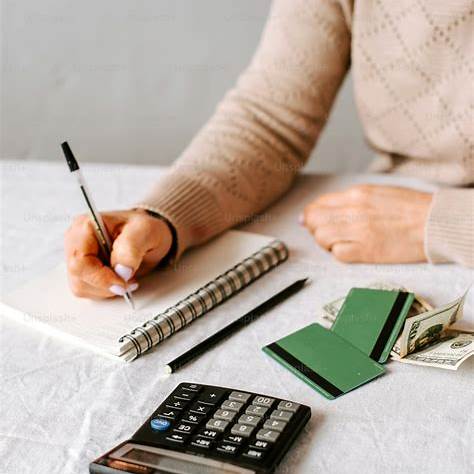

Cash is king for wealthy homebuyers, and their preference for laying down greenbacks is pushing up prices for America’s fanciest digs. The creme de la creme of the housing market has hit new heights, with the median sale price for luxury homes rocketing to $1.23 million in this year’s first quarter. A peek at Redfin’s numbers shows an 8.7% spike from early 2023—almost twice the pace of price hikes in more modestly priced abodes.

Meanwhile, the middle slice of the housing market isn’t being left behind. The latest figures tell us the median sale price for these mid-tier homes has jumped 4.6%, reaching $345,000 over the past year. As for the lower third of the market? That part didn’t make it into the report.

One of the primary reasons for the deviating sales data is that wealthier shoppers are more likely to have flexible financial options, increasing their ability to bypass obstacles by paying cash. The trend is seemingly reinforcing the expansion of home sale prices among the most high-end houses at a faster rate than other, less-expensive properties.

Take into account that, according to Redfin, around 46.8% of luxury homes were purchased solely with cash in the three months that ended February 29. This makes for an increase that is the highest share of all-cash luxury home purchases in approximately 10 years; up from 44.1% last year.

Even while the inventory of high-end luxury properties has rapidly increased this year, prices for the most expensive homes have also continued to climb. In all, the total number of luxury homes on the market leaped by 12.6% in the first quarter, compared to one year ago. According to Redfin, new listings jumped by almost 19%.

On the other end of the spectrum, the number of homes in the middle-third of the market plummeted 2.9% in the same three-month period. The average home prices have been growing more and more unaffordable for the average American, which is at least partially a result of recently low inventory.

Another facet of the present situation has been that many are very reluctant to sell their homes because they would then be forced to face buying another property at today’s much higher mortgage rates. Additionally, many current homeowners have been watching their home equity continue to increase in value over the years, which makes them even more hesitant to walk away from the accumulating wealth.

The Redfin report refined the details, whittling down the final numbers relevant to sales. In comparison to one year earlier (January-March 2023), the total sales of luxury homes increased by 2.1% in the first quarter. Simultaneously, the total number of sales of properties in the middle-third of the market dropped by at least 4.2%.

Redfin added that property buyers are effectively hit with the major double-whammy of increased home prices coinciding with rising mortgage rates, and today, purchasing a home is costlier than at any other time in the last 10 years.