Image credit: Unsplash

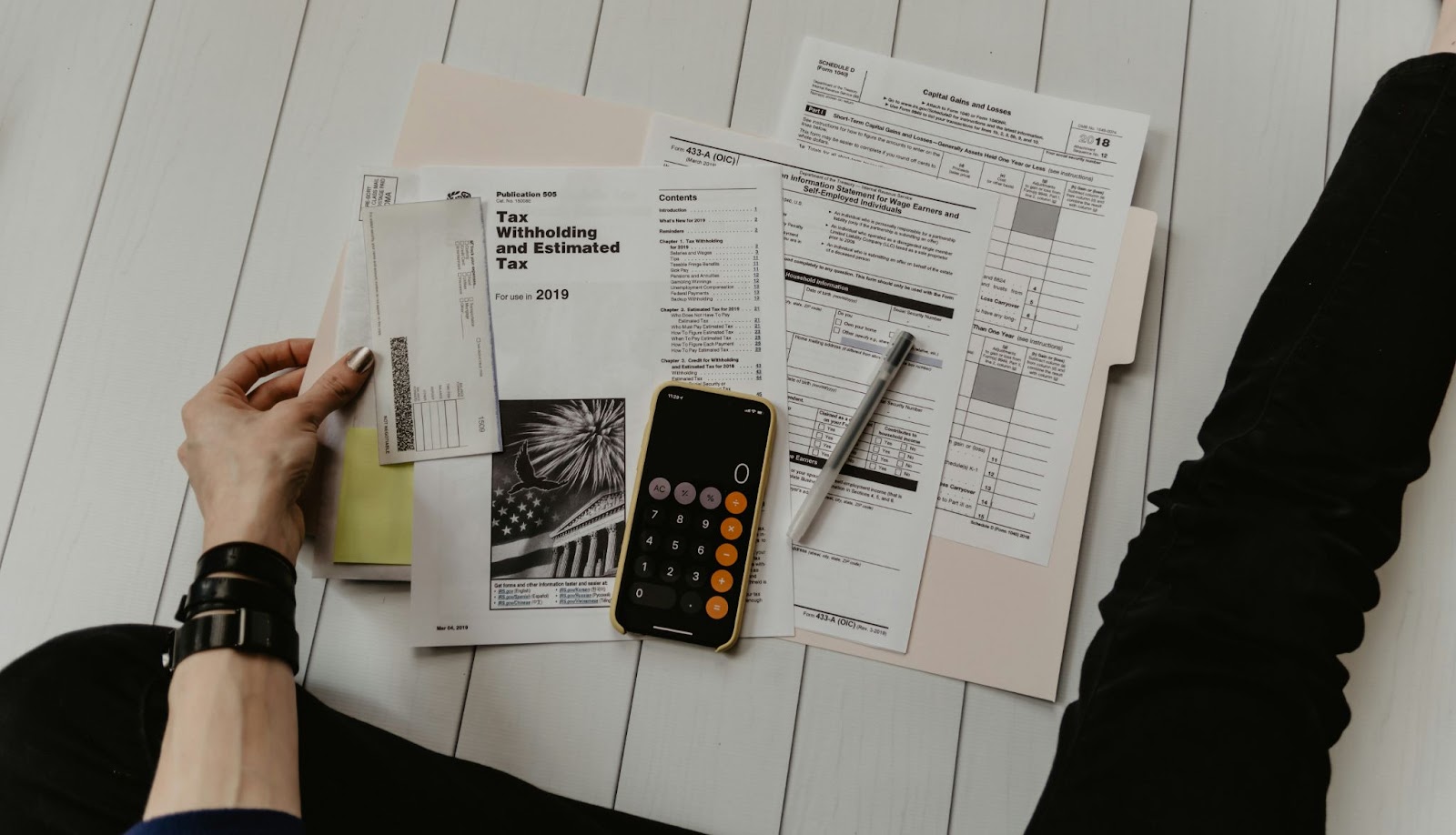

In a dramatic shift in the economic landscape, New York has seen a significant exodus of its wealthiest residents. Since 2019, ten billionaires have left the Empire State, creating a tangible impact on New York’s tax revenue.

According to the Forbes 400 list, the number of New Yorkers among the nation’s richest has dwindled from 72 in 2019 to 62 in 2023. The majority of these financial titans have chosen Florida as their new domicile, drawn by factors including the absence of a state income tax.

This migration trend isn’t limited to the ultra-wealthy. Data from the United States Census Bureau indicates a broader demographic shift, with 91,758 individuals moving from New York to Florida in 2021 alone. The appeal of Florida has been multifaceted, with its favorable tax environment being a significant lure for those with substantial wealth.

Jared Walczak, vice president of the National Tax Foundation, highlights the stark contrast in tax burdens between the two states. “You have this incredibly high rate imposed on all of the income of the highest earners [in New York], and living just about anywhere else will substantially reduce your tax burden,” Walczak explained in an interview with the New York Post. “Going to Florida will obviously eliminate your individual tax burden, and many of these billionaires clearly have that flexibility.”

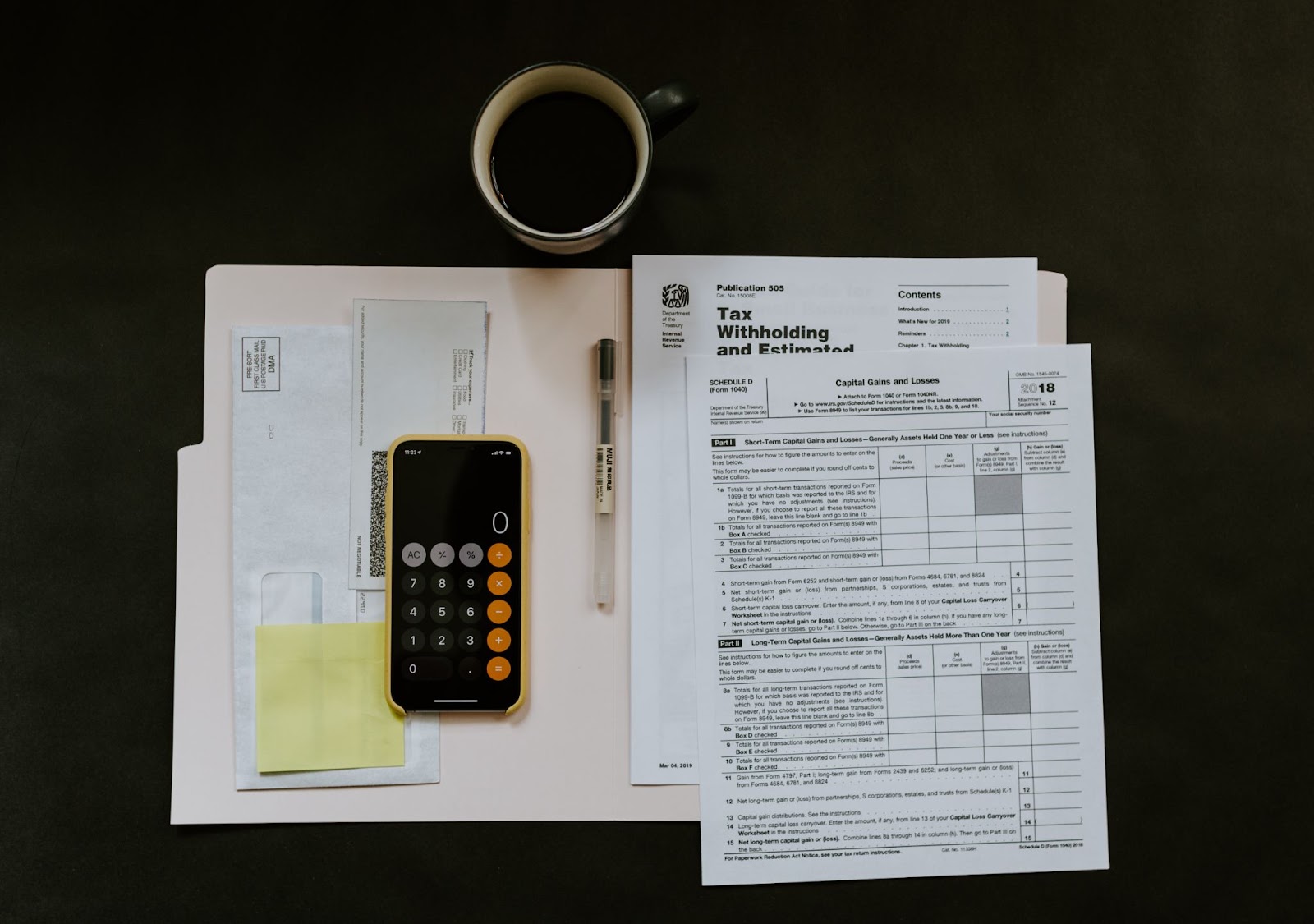

This exodus is not just a matter of personal finance for the billionaires; it has broader implications for New York’s economy. Walczak noted that New York’s top 1% of taxpayers are responsible for a staggering 42% of the state’s tax receipts. With the state’s highest income tax rate at 14.8%, the lure of Florida’s 0% personal income tax rate is undeniable.

The departure of these billionaires and thousands of other New Yorkers represents a significant challenge for New York’s fiscal planning. The state has long relied on its wealthiest residents to bolster its tax revenues, a strategy that is now proving to be vulnerable as more residents seek tax-friendly states.

Governor Ron DeSantis of Florida has cited this migratory trend as an endorsement of his leadership, contrasting it with the leadership in New York. In the recent GOP presidential debates, DeSantis emphasized his accomplishments in Florida, including cutting taxes, to bolster his candidacy. The increasing move from the Empire State to the Sunshine State under his governance has become a point of pride and a political talking point.

In light of these moves, New York may need to address whether their tax strategy has long-term sustainability. As both wealthy individuals and businesses relocate to tax-friendly states, the need to balance revenue with maintaining a competitive tax environment becomes crucial.

Moreover, this shift underscores a broader national trend where individuals and businesses are increasingly mobile and willing to relocate in response to tax and regulatory environments. This mobility has intensified competition among states for both residents and businesses, with tax policy playing a pivotal role.

As New York grapples with the implications of this wealth migration, it serves as a case study for other states in managing their tax policies to retain and attract residents and businesses. The outcome of this dynamic will have far-reaching implications for state fiscal policies and economic strategies in the years to come.