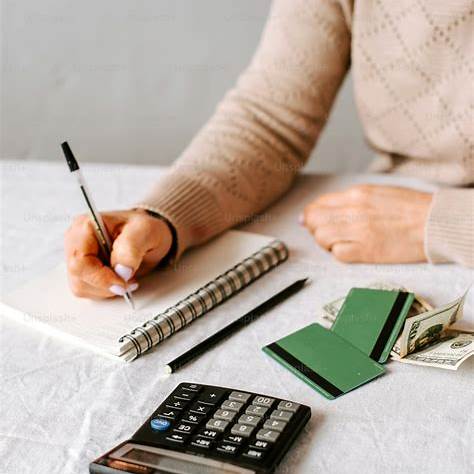

Image credit: Unsplash

While all eyes are on the luxury market in China, which is seeing a decline in sales, cracks in the US luxury market are beginning to show, with companies such as LVMH, Tapestry, Capri Holdings, and Ralph Lauren reporting a slowdown in North America. Luxury market sales in the US may not drop as steeply as in China, but they are falling here.

“The US luxury market continued its downward trajectory in the second quarter 2024, even as inflation eased,” shared Michael Gunther, who heads up insights at Consumer Edge (CE), which tracks over 100 million US credit and debit card payment accounts, slices the data to learn where purchases are made, and learn spender demographics.

“The brands that are more dependent on high-income shoppers are holding up better, but still, high-income spending is down, dropping by 5% in the second quarter 2024, the lowest point since second quarter 2020. And the gap between spending on brands that over-index to high-income consumers is narrowing compared with those that index to lower-income consumers which were down 8% same period last year.”

Almost every luxury brand is expected to feel the heat if US consumers continue to pull back since Americans accounted for almost 30% of revenues in the nearly $400 billion spent on personal luxury goods last year.

“The biggest takeaway from the data is that the weakness is broadening,” Gunther added. And that is what the latest results from LVMH and native American luxury brands Tapestry, Capri, and Ralph Lauren reveal.

Trouble Shows for LVMH

A leader in the luxury market, LVMH, reported that in the first half of 2024, revenues in the US dropped 1%, from $11.4 billion to $11.3 billion. Their Fashion and Leather Goods segment, which accounts for half of consolidated revenues and where big names like Louis Vuitton, Dior, Fendi, and others report, suffers from consumer pullback, down 2% globally in the first half.

Tapestry Sales Drop

Tapestry’s fiscal fourth quarter, ending June 29, was disappointing. Revenues were reportedly down 2% to $1.6 billion.

This luxury brand heavily depends on its North American consumers, accounting for nearly two-thirds of Tapestry’s revenue. Tapestry relies on sales from Coach and other brands, like Kate Spade and Stuart Weitzman, to produce profitable results; however, many of Tapestry’s brands are in retreat, with Weitzman underperforming, off 19% in the quarter and 14% for the year.

Capri Holdings Feels the Heat

The luxury market slowdown has hit Capri Holdings. Its revenues dropped 13% to $1.1 billion in the first quarter of 2025 and closed fiscal 2024 at $5.2 billion, off 8%.

The company’s three brands declined last year, with Versace, Jimmy Choos, and Michael Kors feeling the heat of consumer pullback. This decline only accelerated in the first quarter. Versace was down 15% to $219 million, Jimmy Choo dropped 6% to $173 million, and Michael Kors was off 13% to $675 million.

Ralph Lauren Fares Slightly Better

As a global leader in luxury lifestyle, Ralph Lauren’s top line looked solid, with first-quarter 2025 revenues through June advancing by 1% to $1.5 billion. The company ended fiscal 2024 at $6.6 billion, up 3% over $6.4 billion in the previous year.

Despite the uptick in sales, North America revenues decreased 4% in the first quarter to $608 million. US consumers accounted for 40% of the company’s total revenues, coming off a year when North American sales declined 2% to $3 billion, 45% of its total.

Affluent Americans, often the prime target customers for luxury brands, generally believe their financial status is secure; however, in a June survey among 400 affluent, almost one-fourth reported they are worse off now than three months ago. With less confidence in the US economy’s financial stability, these consumers’ willingness to indulge in luxury items drops.