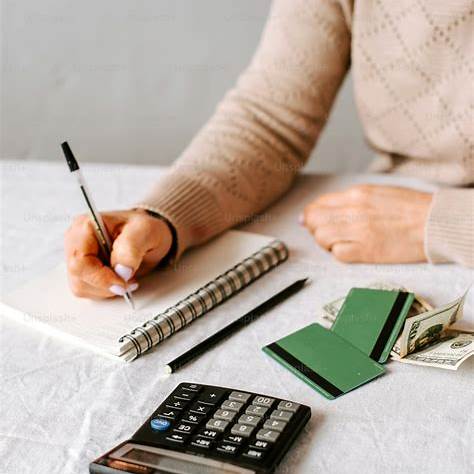

Image credit: Unsplash

It looks like IPOs are going to be big again starting in 2024. Goldman Sachs has forecasted a significant uptick, and the multinational financial hub EY has reported that public offerings in the first half of 2024 generated $18.6 billion in proceeds. That’s a significant increase from last year.

Kerry Blum, the global head of the equity-structuring group in the private-wealth management wing of Goldman Sachs, recently spoke in an interview about how founders use IPOs and what strategies they can employ to get the most out of them. Blum knows what she’s talking about. Her team provides support for plenty of high-net-worth clients and offices, often strategizing about things like trust and estate planning, but also advising how and when company founders should cash in. Put simply, she’s the expert.

“When someone has invested a significant amount of their life in creating a company and establishing a leadership team, we appreciate that there is a lot of emotion tied to that asset,” Blum said. “We understand that the decisions they’re making are both economically and emotionally important.”

In her interview, Blum emphasized three major strategy points that founders can keep in mind when approaching IPOs.

1. Talk With Your Advisor As Soon As You Have the Idea

If a public offering is likely to be on the table at any point, bring that up with advisors as soon as you can. A pre-IPO founder who has a relationship with a wealth advisor shouldn’t hesitate to get whatever advice they can early on, and Blum said it’s not unusual for this to happen years ahead of time. Then, three to six months before the IPO listing date, the conversations get much more real.

“We’ll be more engaged with clients on a more regular basis to help them understand,” said Blum, “What does the landscape look like? What should they be expecting? And what does that final to-do checklist look like as they approach the IPO?”

2. Be Careful About the Signals Your IPO Listing Will Send

When you decide to sell off stakes and equity in your company, that sends a powerful message. Make sure it’s the right one, especially if the step coincides with other processes, like the issuing of securities filings, which is common for this stage.

“You get to take a company public once. You get to make your first sale as a founder once as well,” said Blum. “So we want to make sure that we’re being mindful of the messaging and signaling considerations.”

Advisors can help founders to get this right. For instance, Blum and her team track what other founders are doing and use this information to help her clients answer questions about how peer founders see their own companies and how and when others are selling.

3. Know Why You’re Doing This, Short Term and Long Term

In many ways, post-IPO management won’t be that different from how it was before, but it will involve the considerations of new parties and, hopefully, significant new resources. For Blum, this makes it more important to diversify across asset classes. “We also spend some time helping clients make sure that they’ve thought through what could their impact and legacy look like,” Blum said. “And although it’s 10 or 15 years out, it’s never too early to think through how to optimize for those events.”

Are You Thinking About a Future IPO Listing?

If an IPO is on your horizon, take Blum’s first lesson seriously and start thinking and talking about the possibility right away. Do the prep work to make sure your listing will bring with it all the right signals and proper messaging, and know what your long-term goals are ahead of time. This will help you maximize the financial benefits of your IPO listing while setting yourself up to handle the challenges and opportunities you’ll be opening the way to. With great planning and the right guidance, you’ll be that much closer to making 2024’s potential IPO swing work for you.